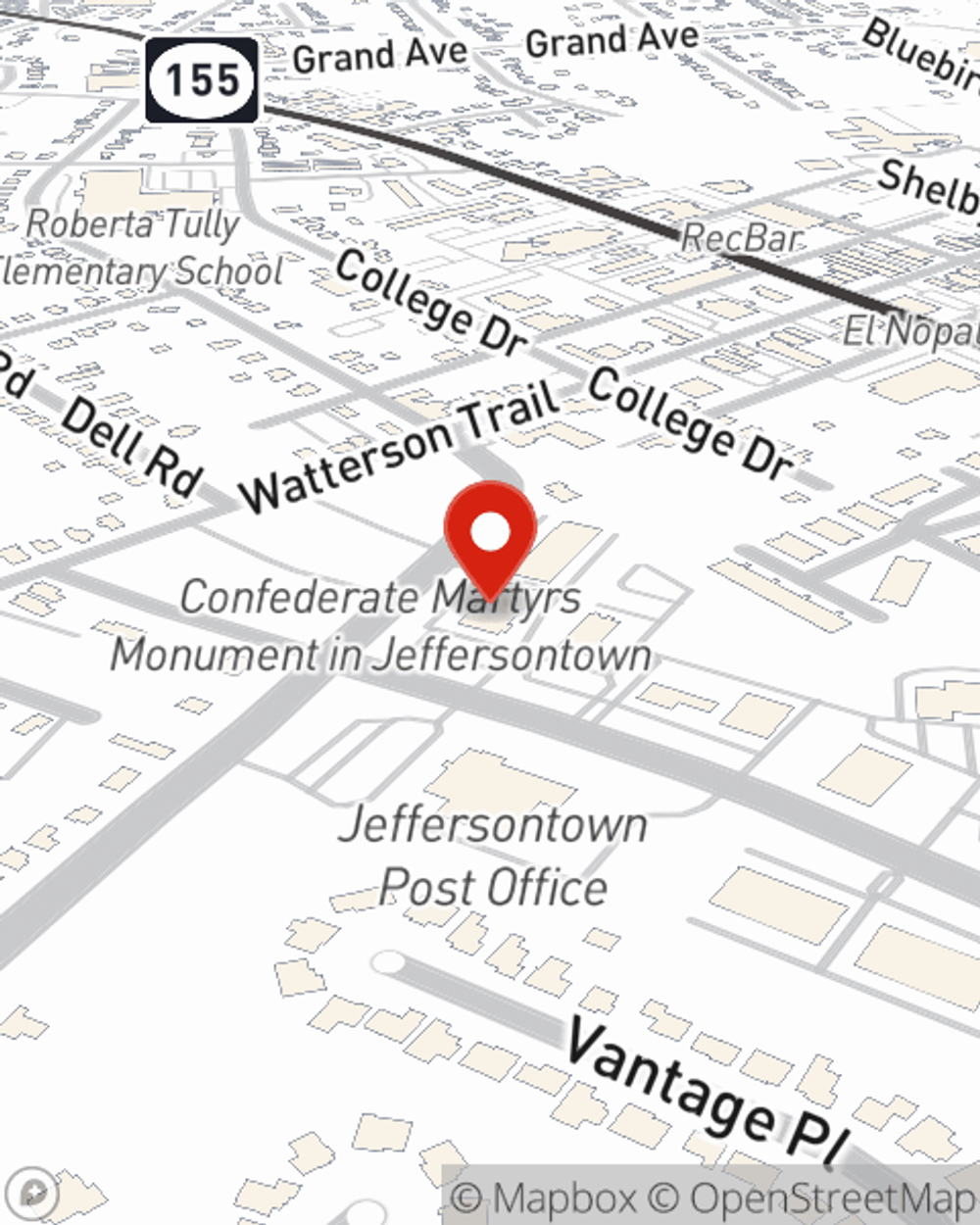

Business Insurance in and around Louisville

Get your Louisville business covered, right here!

Helping insure businesses can be the neighborly thing to do

- Louisville

- Jeffersontown

- Middletown

- Fern Creek

- Anchorage

- Brooks

- Mt Washington

- Fisherville

- Pewee Valley

- Prospect

- St. Matthews

- Germantown

- Springhurst

- Simpsonville

- Jefferson County

Help Prepare Your Business For The Unexpected.

Running a small business comes with a unique set of wins and losses. You shouldn't have to work through those alone. Aside from just your loved ones, let State Farm be part of your line of support through insurance options including errors and omissions liability, a surety or fidelity bond and business continuity plans, among others.

Get your Louisville business covered, right here!

Helping insure businesses can be the neighborly thing to do

Cover Your Business Assets

At State Farm, apply for the outstanding coverage you may need for your business, whether it's a veterinarian, a pottery shop or an ice cream shop. Agent Derek Carlton is also a business owner and understands your needs. Not only that, but exceptional service is another asset that sets State Farm apart. From one small business owner to another, see if this coverage comes out on top.

Agent Derek Carlton is here to explore your business insurance options with you. Reach out Derek Carlton today!

Simple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Derek Carlton

State Farm® Insurance AgentSimple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.